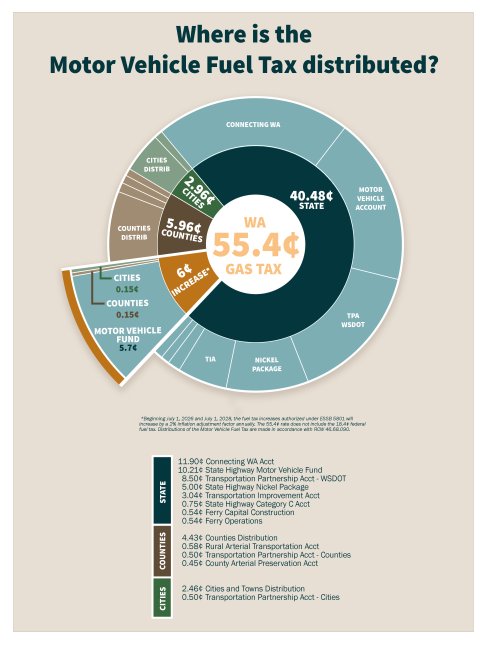

In the State of Washington, the state motor vehicle fuel tax (MVFT), currently 55.4 cents/gallon, is shared among the cities, counties and the state Department of Transportation.

This includes a dedication of a portion of the MVFT to grant programs managed by the County Road Administration Board (CRAB) and the Transportation Improvement Board (TIB). The most recent MVFT increase was primarily dedicated to the Transportation Partnership Account (TPA) utilized for legislatively selected transportation projects (RCW 46.68. 122-124)

Between the Rural Arterial Program (RAP), the County Arterial Preservation Program (CAPP), and the regular county distribution, counties receive a share approximately equal to 5.96 cents per gallon, plus a small amount from the TPA dedicated to CAPP. The county total share of the MVFT is approximately 16% of the net state fuel taxes collected. State law describes the basic processes and authorities to perform the biennial and annual update calculations, with CRAB having the responsibility to perform these calculations pertaining to the counties' share of MVFT.

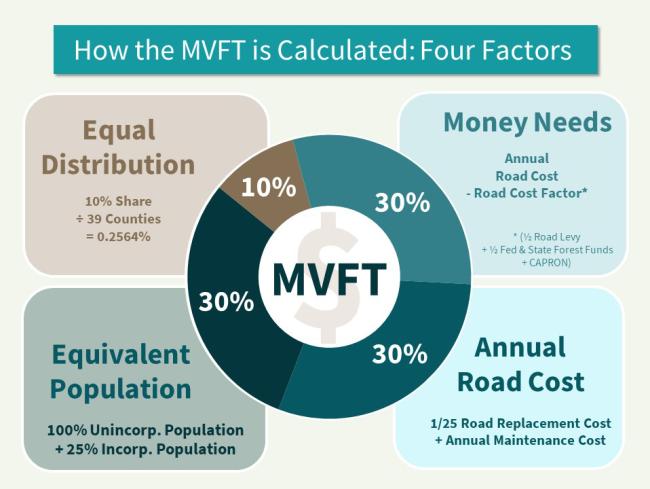

During the mid-1950's, the county fuel tax regular, or "normal", distribution formula was significantly changed, creating what is known as the 10-30-30-30" formula pictured in the right column of this page. Since then there have been only a few minor revisions. The counties' share of the state motor vehicle fuel tax (less administrative, island county refunds and special studies deductions) is divided among the 39 counties as follows: 10% shared equally, 30% based on "equivalent" population, 30% based on "road costs" and 30% based on "money needs.

The current county gas tax formula for distribution to the counties has been in effect with only minor revisions since 1954 and last amended in 1988.

The final report to the Legislature in 1954 discussed the formula and how it addressed needs and concluded that the current formula was the most equitable. In 1985 CRAB was given the responsibility in determining each county's share of the gas tax, which includes the biennial and annual calculations:

There are four factors used in the calculations:

Equal Distribution (10%)

Equivalent Population (30%)

Annual Road Costs (30%)

Annual Money "Needs" (30%)

Under state law gas tax control field information is collected to help the County Road Administration Board estimate road replacement and maintenance costs for county fuel tax allocations.

Control fields are those fields utilized for the computation of gas tax allocations in accordance with (RCW 46.68.124). The control fields are: Unique identifier (county road number, beginning milepost, ending milepost), jurisdiction, length, function class, surface type, surface width, right and left shoulder type, right and left shoulder width, and average daily traffic volume. All control field updates are subject to review, approval and must be validated by the County Road Administration Board.

More information on the history, calculations, distributions and future of the Motor Vehicle Fuel Tax is available here.

Reports

- Motor Vehicle Fuel Tax Reports

-

2026 Motor Vehicle Fuel Tax Estimated Revenues

2025 Motor Vehicle Fuel Tax Estimated Revenues

2021 Fiscal Year Motor Vehicle Fuel Tax Estimated Revenues

2021 Calendar Year Motor Vehicle Fuel Tax Estimated Revenues

- Past Reports

-

2026 CAPP Allocation Factors Estimated Revenues

2022 CAPP Allocation Factors Estimated Revenues

2021 CAPP Allocation Factors Estimated Revenues

2020 CAPP Allocation Factors Estimated Revenues

2019 CAPP Allocation Factors Estimated Revenues

2018 CAPP Allocation Factors Estimated Revenues

2017 CAPP Allocation Factors Estimated Revenues

2014 CAPP Allocation Factors Estimated Revenues

2013 CAPP Allocation Factors Estimated Revenues

2022 Motor Vehicle Fuel Tax Estimated Revenues

2020 Motor Vehicle Fuel Tax Estimated Revenues

2019 Motor Vehicle Fuel Tax Estimated Revenues

2018 Motor Vehicle Fuel Tax Estimated Revenues

2016 Motor Vehicle Fuel Tax Estimated Revenues

2014 Motor Vehicle Fuel Tax Estimated Revenues

2013 Motor Vehicle Fuel Tax Estimated Revenues

Additional Resources

- An estimate of 2025 revenues by county for 2025 may be found here.

- A valuable reference tool is WSDOT's Transportation Manual (State Taxes and Fees). Click here to view the manual, page 45 contains Motor Vehicle Fuel Tax information.

- Revenue forecast links on the OFM website: http://www.ofm.wa.gov/budget/info/transportationrevenue.asp